- #FREELANCE BOOKKEEPING HOW TO#

- #FREELANCE BOOKKEEPING PRO#

- #FREELANCE BOOKKEEPING SOFTWARE#

- #FREELANCE BOOKKEEPING PROFESSIONAL#

While Freshbooks has grown to service companies of all sizes, it has a long history of working with freelancers.

#FREELANCE BOOKKEEPING SOFTWARE#

Next up on our list of best accounting software for freelancers is Freshbooks. Starting at $16 monthly, they have everything you need to run your freelance business without any limits.Ĭlick here to get started with Moxie.

#FREELANCE BOOKKEEPING PRO#

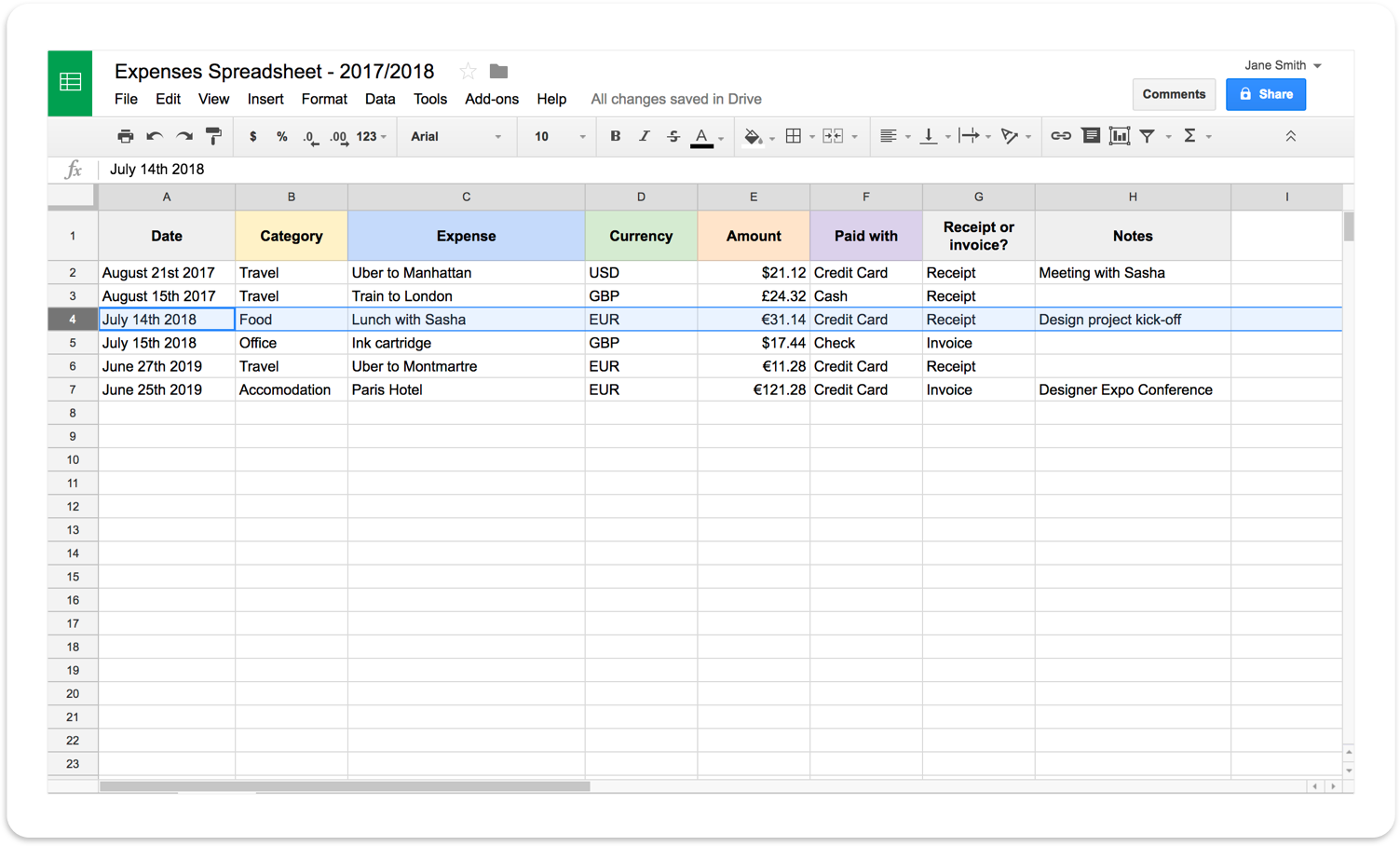

Moxie supports two paid tiers, Pro and Teams. Moxie plays nicely with all the tools accountants love, like Xero, Quickbooks, and more. Need to finish off your finances elsewhere? Not a problem. Here’s a quick overview with further details below: But I’m here to tell you, that’s not the way to do it.īuilding a financially viable freelance business-one that survives for a long time-relies on finding the best accounting software for freelancers.īut with so many options out there, how can you possibly know which accounting software to use as a freelancer? After researching dozens of accounting software for freelancers, I’ve narrowed them down to the list below with explanations as to why. I’ve been there: using a Google Spreadsheet to track all of my PayPal and bank transactions and then hoping that my books all add up at the end of the month.

And without good accounting software, it’ll be hard to watch your finances. Getting your money organized using accounting software can take your freelance business from a hobby or side-hustle to a full-fledged business.Īfter all, if you’re not paying attention to your finances, you won’t be in business for long.

#FREELANCE BOOKKEEPING HOW TO#

Sign a contract with clients interested in retaining your services. Explain your services in more detail, your bookkeeping and payroll processes and your fees. Schedule an introductory meeting with individuals interested in your business. Introduce yourself to business owners and give a brief explanation of your business and the services you provide.

A bookkeeper with many years of experience typically charges more than a bookkeeper with little experience.

#FREELANCE BOOKKEEPING PROFESSIONAL#

Bookkeeping and payroll rates vary by region and professional experience. Consider charging extra fees for mileage if you must travel to your clients’ offices. Decide whether to set an hourly rate or a flat monthly fee. Call local bookkeeping and payroll companies to ask their prices, which will give you an idea of what to charge your clients. Obtain training in several accounting software programs to meet the needs of your clients. Verify that your computer meets the specifications of the software installation requirements. QuickBooks (from Intuit- ) is a low-cost bookkeeping and accounting software package that is widely used by small businesses in the North America. Choose software you can customize to your clients’ needs, that’s easy to use and inexpensive.

Steps to take to become a Freelance Bookkeeper: As a freelance bookkeeper and payroll service provider, you set your own prices, take on as many clients as you desire and establish the services you wish to provide. Other small companies do not need permanent staff because of their small financial requirements. Some companies cannot afford to hire staff permanently, so they employ the services of freelance bookkeepers. Accurate bookkeeping and payroll services are important to the successful operation of a company. Nearly every company needs bookkeeping and payroll services. By definition, a person who provides freelance bookkeeping services sells their services by the hour, the day, or the job rather than working on a regular basis for one employer.

0 kommentar(er)

0 kommentar(er)